- #Best money manager for mac software#

- #Best money manager for mac free#

- #Best money manager for mac crack#

#Best money manager for mac free#

While Acorns doesn’t technically have a completely free trial, we let it sneak in to this roundup for just $1, you can try it out for a month. And with their Earn program, every time an Acorns user shops at select retailers (the list is currently at about 200 partner brands, including Airbnb, Home Depot, and Sephora), you get extra money back. Acorns Later lets you save into a Roth, Traditional, or SEP IRA, and you can add a full-featured checking account ($3/month). Grow is its educational arm – a robust set of articles and videos, available with or without an account. You can also set automatic savings transfers to your Acorns account – you’re not limited to the round-up pennies.Īs Acorn has grown, so has its ecosystem, and now it really is competitive in the realm of best personal finance software. Acorn puts your money into a diversified portfolio of ETFs, so you’re dabbling in the market, too. So you keep tossing money into savings without really noticing it's happened. The concept is simple: Link your credit or debit card to the app, and whenever you make a purchase, the app rounds up to the nearest dollar and directs those extra pennies to an account. "Round-up" apps have become common in recent years. Change is hard! But if you’re just starting out, take a look at Mint or Personal Capital for a lower-cost way to keep track of your ducats.

In a nutshell: People who have spent years mastering Quicken (and entering their data) have good reason to stick with it.

#Best money manager for mac software#

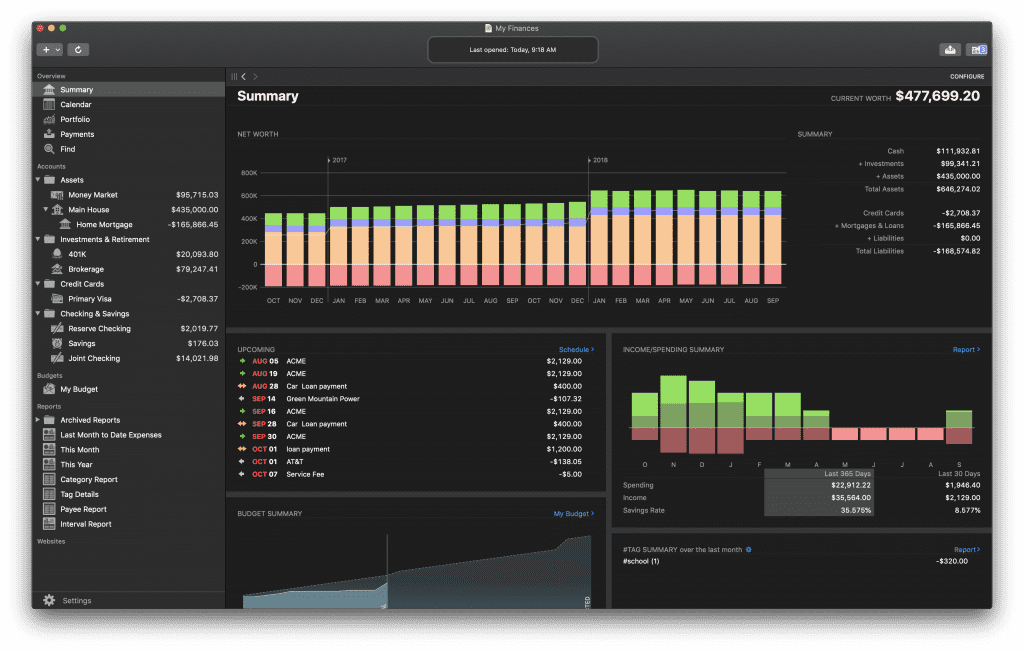

That’s a pretty hefty price tag for personal financial software that, for most users, isn’t much different than the free competition. While there’s no arguing with Quicken’s feature set, the switch to a subscription model brings Deluxe to $42 a year. Capital know how tied people get to their historical data. Still, we can’t help but suspect that its owners at H.I.G. Today, you can view balances and transactions, identify spending trends, and check the performance of your investments from anywhere you can get to a browser. Since 2019, Quicken users have had the added benefit of a browser interface that lets them interact with their finances on the go.

For lovers of detail, thoroughness, and tailoring their financial management, Quicken is a great fit. Supported account types include investment, retirement, and loan accounts, as well as asset tracking for insurance purposes. Quicken lets you transfer money between accounts at different institutions, provides specialized investment reports, and helps you create a tailored plan to pay down your debt. Longtime Quicken users are familiar with the software’s top-notch budgeting, planning, and spending-analysis tools that have long complemented their robust account-management features. And you get more exporting and customization options than Mint, which makes Quicken one of the best personal finance software options.

The feature set is as robust as any personal finance software out there. Price: $41.99/year, with 30-day free trialįor the oldest player on the field, Quicken’s still got it. Mac version still lags behind PC, missing multiple currency support and some credit reporting -Free support has limited hours New in 2021, you can bulk-edit to make category adjustments.

#Best money manager for mac crack#

Mint makes setting up a budget a simple and straightforward process: Once you’ve set up your accounts, Mint takes a crack at categorizing your expenses for you. Life is complicated enough already, and you can start your new era of fiscal responsibility right now by saving yourself the $42 annual price tag for Quicken Deluxe. While Mint and Quicken have long been the top contenders for full-featured financial management for everyday finances, Mint wins as the best personal finance software by being both free and slightly simpler than Quicken. Many users love its simple, clean UI - the 2021 design refresh is getting raves - and at-a-glance financial dashboard, with net worth right there at the top. Mint is a web-based tool (with mobile apps, of course) that will help you track spending, design a budget, manage debt, set goals and combine all your accounts (including the weird ones like balloon mortgages) in a single place. If you’re looking for a one-stop shop in your personal finance software and want a full-featured tool that still keeps things simple, Mint is the choice for you.

0 kommentar(er)

0 kommentar(er)